Nowadays, investing has become easier than ever. Many companies offer their app to invest in mutual funds by just using your phone. To make investing more fast, easier to manage, KFintech & CAMS launched MFCentral. But should you really trust MFCentral? Is it safe? How to use it? In this article, we will explore MFCentral, and provide you with every information about the platform.

Table of Contents

What is actually MFCentral?

MFCentral (Mutual Fund Central) is India’s first all-in-one investment management platform made for Mutual Fund Investors, launched in September 2021. It’s a joint venture between CAMS and KFintech, two of India’s largest mutual fund registrars and transfer agents (RTAs). MF Central is a free and easy-to-use platform designed to streamline the mutual fund investment process for individual investors in India.

The platform aims to enhance user experience by providing a single-window solution where investors can view their entire portfolio, execute transactions, and handle various non-financial tasks such as updating personal information or merging folios. Investors can access their mutual fund holdings through a unified interface by simply entering their PAN and mobile number.

Even Non-Resident Indians can use MF Central if they have a PAN, but some features are locked for NRI investors.

Is MFCentral Safe to use?

MFCentral is designed with enhanced security measures to ensure the safety of users’ personal and investment data. The platform operates as a collaborative effort between CAMS and KFintech, integrating services from various RTAs. Importantly, all sensitive information remains securely stored with the RTAs, which have established protocols for data protection. MFCentral itself only populates data available in the RTA system and retains minimal login credentials in a highly secure environment, which further safeguard user information.

According to Applied Cloud Computing, in terms of technology, MF Central employs advanced security practices, including monitoring through services like Amazon Guard Duty and CloudWatch. These tools help track metrics, monitor log files, and react to any changes in AWS resources, ensuring that the platform operates smoothly and securely. The infrastructure is built to maintain high standards of security, making it a reliable choice for investors looking to manage their mutual fund portfolios online.

Is MF Central Government or Private?

MF Central is not a government initiative; it is a collaborative platform developed by two private companies, CAMS and KFintech, which are the largest RTAs in India’s mutual fund industry. CAMS and KFintech are not government entity; those are private companies. However, their platform MF Central is one of the platform which is created as per the directives of the Securities and Exchange Board of India (SEBI). So, you no need to worry about security and privacy while using MF Central, it is fully secure and safe to invest through it. Even though brokers like Upstox and Dhan use MF Central in their platform to import users’ mutual fund portfolios or external investment details on their platform.

Top Features of MF Central

MFCentral supports various transaction types such as lumpsum purchases, SIPs, SWPs, and STPs, Switch fund, Redeem, etc. One of the highlighted features of MFCentral is its ability to facilitate non-financial service requests seamlessly. Investors can update personal details like contact information and bank account details, consolidate folios, and manage nominations—all through a paperless process. The platform also provides a comprehensive view of an investor’s holdings, displaying metrics such as invested value, current market value, and profit/loss percentages.

How to Use MF Central?

There are 2 ways to use MF Central: using their official website, or their apps on Play Store and App Store. Laptop and PC users are suggested to use the website, while mobile users can install the MFCentral app.

If you are using MFCentral for the first time, it is important to create an account first. To create an account, you need to Sign up, then Sign in/Login to your account in future. Here is the account creation process:

- Open Sign up or account creation page at https://app.mfcentral.com/investor/signup

- Click on Get Started.

- Enter your PAN number.

- Enter your registered mobile number.

- Click on “I’m not a robot.”

- Click on “I agree and accept the Terms & Conditions.”

- Click on Create Account button.

Additionally, they may ask you a few Security Questions like “Which city you were born in?”, etc. Answer those questions and write those questions and answers in your notebook or on a paper. Keep it, because when you login next time on MFCentral, they may ask these questions to verify that it’s you. However, there is an option to reset security questions in case you forget these questions.

When you have an account on MFCentral, you can easily access your mutual fund portfolio. Here is how to login:

- Open Sign in or login page at https://app.mfcentral.com/investor/signin

- Click on toggle button between Password and OTP, and set it to OTP.

- Click on Generate OTP button.

- Copy and paste the OTP sent to your mobile number.

- Click on “I’m not a robot”.

- Click on Verify OTP button.

- Enter the answer for the security question, click on Submit button to successfully sign in.

After sign in, click on the View Portfolio, and you can see your mutual funds details in SoA holdings section. To check your mutual funds holdings, select “Asset Class wise Details.” Here in the “Holding Type,” select Non-Zero Holdings. Now you can see all your portfolio holdings including Equity, Debt, and Liquid.

How to Invest using MFCentral?

To invest in the existing funds of your portfolio, click on the fund name that exists on SoA holdings, below “Asset Class wise Details” section. Then click on the Invest More button.

To invest in the other funds that are not currently exist in your portfolio, open Menu in the left side, and click on Transact. In the “Make Commercial Transaction” page, click on Lumpsum/SIP. Now select fund type such as, Debt, Equity, Hybrid, etc. You can also use search bar at the top to search for a specific mutual fund scheme.

Then click on the Start SIP or Start Lumpsum button. Here you can enter Lumpsum or SIP amount. In the case of SIP, don’t forget to select investment frequency, SIP day, start-end date, etc. Then click on the checkbox for “I hereby agree to the Terms and Conditions of MFCentral”, and click on the Invest button. After that, pay the investment amount via UPI or Net banking, or any other available method. Once the investment is confirmed, it will reflect on your mutual fund portfolio within 2-3 business days.

How to Change Bank Account using MFCentral?

On MFCentral, you may see an option in the homepage called “Submit Service Requests.” If you are unable to find it then open the left-side menu and click on Service Requests. Then click on the Change of Bank Account Details. Choose fund houses that you want to update your bank details, and click on the Submit button.

Now you need to enter the new bank account details. First, enter your bank account number. Then enter the IFSC code of your bank location. After entering the IFSC, bank name, city and branch will be detected automatically. Then click on Proceed, after verifying the bank name, city, and branch information.

At the end, upload the required document of default/current A/C as a proof, and the new bank A/C document proof that you want to add. Document proof should be in pdf, jpg, jpeg, and png format with a file size of less than 2 MB. You can use pdf or image compressor websites if your document or image size is larger than 2 MB. After uploading the documents on MF Central, click on the Submit button.

How to Update Nominee using MFCentral?

Updating nominees is as simple as changing a bank account. You just need to open that same “Submit Service Requests” page. Find and click on Update Nominee Details. Select a fund house and click the Next button. From here, you can edit, delete, or add a nominee. After adding all the required details, click on the Submit button.

Info! OTP may be sent to your registered mobile number when Submitting Service Requests on MF Central. So, verify with the OTP carefully, and complete the process.

FAQs

Is MF Central a broker and provide a demat account?

No, MF Central is not a broker and it doesn’t provide a demat account. It is a simple platform to access and manage your mutual fund portfolio with the help of PAN and Password or OTP.

Can I invest through MF Central?

Yes, you can easily invest through MF Central. The platform provide Lumpsum and SIP option with various fund types like Equity Mutual Fund, Debt, Hybrid, Solution oriented, etc.

MF Central vs Groww, which is better?

It is depend on which type of investor you are. If you invest in both stocks and mutual funds, then Groww will be a better choice. On the other hand, if you invest only in mutual fund, then MF Central will be a better choice, because MF Central provide more control over your mutual fund portfolio.

However, if you frequently change your mutual funds in the portfolio, then Groww may provide more advance option to track a mutual fund return, top performing funds, and more.

For long term mutual fund investors, MF Central is the best platform. Because the platform is managed by CAMS and KFintech, who are India’s largest registrar and transfer agents (RTAs).

How to Contact MF Central Customer Care?

You can contact MF Central customer care through their official support email: [email protected]

However, they currently do not provide a number for direct support through phone calls dedicated to MF Central. Although, you can contact the makers of MF Central. You can call the CAMS support at 1800-419-2267 or 1800-419-2268, Source. You can also contact the KFintech at 18003094034, Source.

MF Central vs MF Utility which is better?

MF Central is way better than MF Utility. MF Central is a newly launched platform compared to MF Utility, with more advanced features and a better user interface designed to provide an improved user experience. Furthermore, the development team of MF Central is active as they actively manage and update their MF Central platform for latest operating systems.

We further visited multiple forums on the internet to learn about other users’ experiences and found that most users recommend MF Central over MF Utility.

Are there any charges for using MF Central?

No, MF Central is a free platform for mutual fund investors. It allows users to access a wide range of mutual fund related services, without any charges. However, charges may apply for services outside the platform, depending on the fund house (AMC) or third-party service providers that facilitate transactions or offer related services.

How do I delete my MFCentral account?

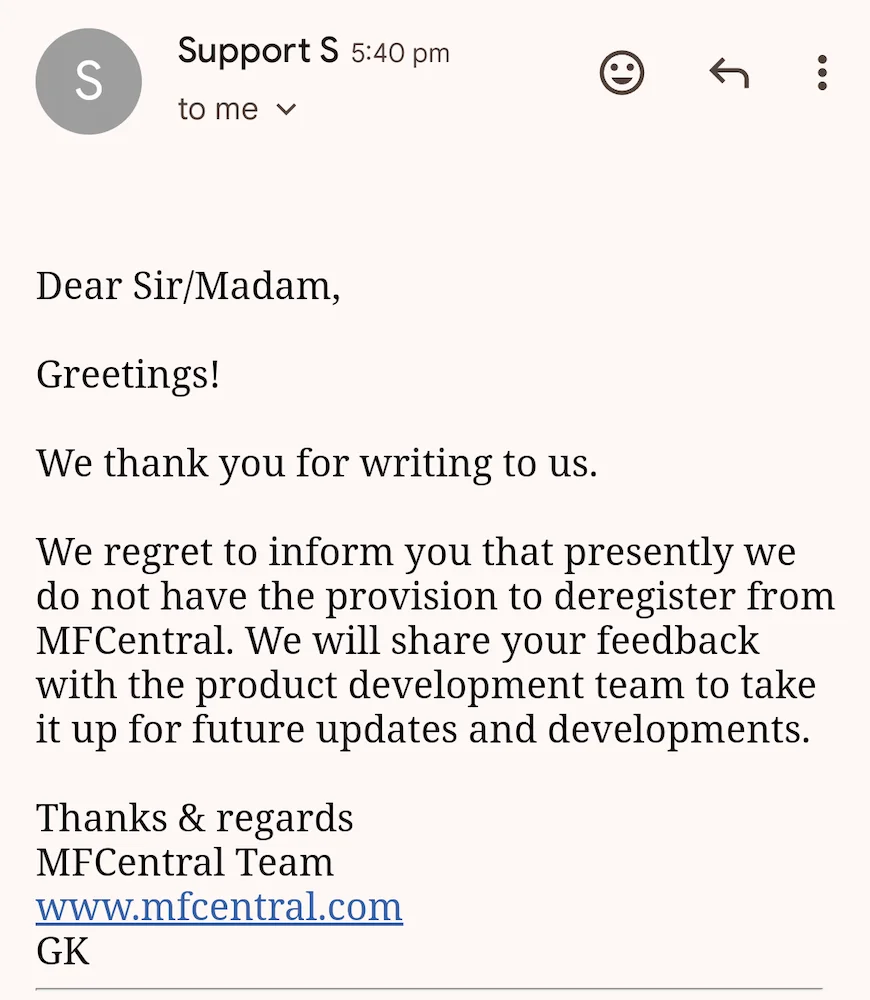

Unfortunately, there is no option to delete an MF Central account. Mutual Fund Journal contacted MF Central through email support, and they replied that presently they do not have the provision to deregister from MFCentral.

Here is the screenshot of their email response regarding account deletion:

In this article, we have explained briefly about MFCentral. If you have further queries, do let us know in the comments below.

Like this article? Get our weekly newsletter

Free newsletter with the best mutual fund stories every week!

Leave a Reply

You must be logged in to post a comment.