Achieving financial freedom is everyone’s dream today. One of the easiest ways to achieve it is by investing in Equity Mutual Funds. There are different types of schemes available in the market. Some of them are actively managed, while others are passively managed. These passively managed funds are known as Index Funds. In this article, a total of 8 index funds (5+3) are mentioned that have the potential to offer higher returns and a lower expense ratio.

Table of Contents

What are Index Funds?

Index funds are a type of mutual fund designed to replicate the performance of a specific market index, such as the Nifty 50 or the BSE Sensex. Unlike actively managed funds, which rely on fund managers to select stocks and make investment decisions, index funds follow a passive investment strategy. This means they invest in the same securities that comprise the underlying index, which maintains the same proportions as those in the index. As a result, index funds offer investors a straightforward way to gain exposure to a broad market segment without the complexities associated with stock picking.

One of the key advantages of investing in index funds is their lower cost structure. Because they do not require active management, index funds typically have lower expense ratios compared to actively managed funds. This cost efficiency allows investors to keep more of their returns. Additionally, index funds are less prone to human biases and errors since their performance is tied directly to the index they track. This transparency and objectivity make them appealing to both beginner and experienced investors looking for a reliable investment option.

The Pros and Cons of Index funds are mentioned below.

Index funds have gained popularity due to their potential for stable long-term returns. For example, investing in a Nifty 50 index fund provides exposure to 50 major companies across various sectors, such as banking, pharmaceuticals, and consumer goods. This diversification not only helps mitigate risks associated with individual stocks but also enables investors to participate in overall market growth.

Historically, from regular index funds (broad market index), investors can expect returns in the range of 10-12% CAGR over an investment horizon of at least 7 years, while from strategy-based index funds, investors can expect returns in the range of 14-18% CAGR and even more, over an investment horizon of at least 7 years.

Overall, index funds serve as an effective investment option for individuals looking for a low-cost, diversified approach to equity investing. They are particularly suitable for passive investors who prefer a hands-off strategy and wish to avoid the complexities of active management. By aligning with market indices, these funds provide an accessible pathway for investors aiming for long-term financial growth.

Best Index Funds in India

1. Bandhan Nifty Alpha 50 Index Fund

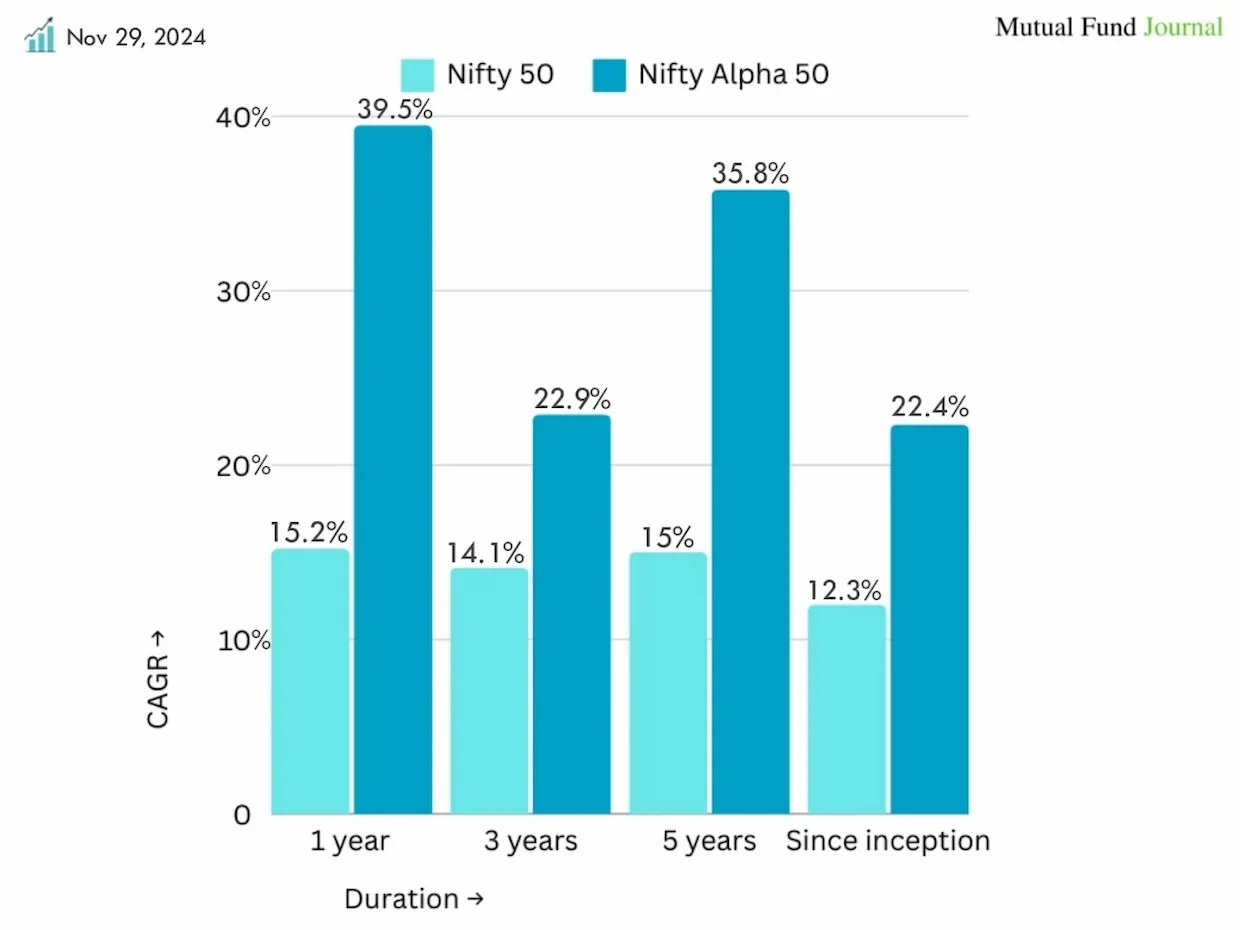

Bandhan Nifty Alpha 50 is the best index fund for investors who want to invest in the Nifty Alpha 50 index. This index fund is one of the top-performing strategy-based funds with high volatility and the potential for higher returns. Here are the historical returns of the Nifty Alpha 50 index:

| Duration | CAGR |

|---|---|

| 1 year | 44.38% |

| 5 years | 35.36% |

| Since inception | 22.33% |

2. Nippon India Nifty 500 Momentum 50 Index Fund

Nippon India Nifty 500 Momentum 50 Index Fund includes the top 50 high-momentum stocks from its parent Nifty 500 Index. This index is a combination of large-cap, mid-cap, and small-cap stocks. If you are specifically looking for a mid-cap-based momentum index fund, consider the Nifty Midcap150 Momentum 50.

Here are the Nifty 500 Momentum 50 Index returns.

| Duration | CAGR |

|---|---|

| 1 year | 43.00% |

| 5 years | 31.49% |

| Since inception | 24.22% |

3. Edelweiss Nifty Midcap150 Momentum 50 Index Fund

Edelweiss Nifty Midcap150 Momentum 50 Index Fund is a best mutual fund to invest in midcap companies through a smart beta strategy-based index fund. The Nifty Midcap 150 represents 150 companies based on full market capitalisation from Nifty 500. Which means 101 to 250 (total 150) companies of Nifty 500 index included in the Nifty Midcap 150. For those who prefer midcap investing with a balanced risk and reward, can consider Edelweiss Nifty Midcap150 Momentum 50 Index Fund. There are 150 companies in the index Nifty Midcap 150, which means top 50 higher momentum stocks are included in the Nifty Midcap150 Momentum 50 Index fund.

| Duration | CAGR |

|---|---|

| 1 year | 40.01% |

| 5 years | 35.59% |

| Since inception | 24.78% |

4. Motilal Oswal Nifty Smallcap 250 Index Fund

The Motilal Oswal Nifty Smallcap 250 Index Fund is a mutual fund designed to replicate the performance of the Nifty Smallcap 250 Index, which includes the smallest 250 companies by market capitalization (companies ranked 251-500) from the Nifty 500 index. The fund is suitable for investors looking for exposure to small-cap equities with a high-risk tolerance due to their inherent volatility.

| Duration | CAGR |

|---|---|

| 1 year | 34.52% |

| 5 years | 30.79% |

| Since inception | 17.12% |

5. UTI Nifty 500 Value 50 Index Fund

From its name, you may already know that this index fund tracks the Nifty 500 Value 50 Index. UTI Nifty 500 Value 50 Index Fund is designed for investors who want to invest using a value investing strategy. Value investing may take time, which is why it’s a good choice for long-term investors.

| Duration | CAGR |

|---|---|

| 1 year | 44.50% |

| 5 years | 34.12% |

| Since inception | 17.44% |

Best Index Funds with Lowest Expense Ratio

1. Nippon India Index Fund Nifty 50 Plan

Every beginner index investor’s choice is the Nifty 50 Index Fund. This is because investing in this index means the invested amount is diversified across different sectors and allocated to India’s top 50 growing companies. Nippon India Index Fund Nifty 50 Plan offers a lower expense ratio and no exit load, which makes it one of the best index funds for those who want to invest in Nifty 50. Here is the historical return data of the Nifty 50 Index:

| Duration | CAGR |

|---|---|

| 1 year | 21.27% |

| 5 years | 16.22% |

| Since inception | 12.63% |

2. Kotak Nifty Next 50 Index Fund

Kotak Nifty Next 50 Index Fund is a type of mutual fund that aims to replicate the performance of the Nifty Next 50 Index, which includes the 51st to 100th largest companies listed on the National Stock Exchange of India, based on market capitalization.

This index fund is suitable for long-term investors looking for capital appreciation while providing exposure to a diversified range of sectors beyond the top-tier companies represented in the Nifty 50.

| Duration | CAGR |

|---|---|

| 1 year | 48.24% |

| 5 years | 20.86% |

| Since inception | 17.24% |

3. Edelweiss NIFTY Large Mid Cap 250 Index Fund

Edelweiss NIFTY Large Mid Cap 250 Index Fund is an index mutual fund that aims to replicate the performance of the NIFTY Large Mid Cap 250 Index, which includes a blend of 100 large-cap and 150 mid-cap companies listed on the NSE. This fund adopts a passive investment strategy, investing equally in both segments to achieve a balanced exposure to the Indian equity market.

The index is rebalanced quarterly, ensuring that it reflects the current market dynamics, which makes it suitable for investors with a moderate to higher risk tolerance looking for growth opportunities over a longer investment horizon.

| Duration | CAGR |

|---|---|

| 1 year | 28.54% |

| 5 years | 22.42% |

| Since inception | 16.54% |

Pros of Index Funds

- Low Expense Ratio: Index funds have a lower expense ratio compared to actively managed funds, which makes them cost-efficient.

- Diversification: They provide exposure to a broad market by tracking indices like Nifty 50 or Sensex, reducing risk.

- Simplicity: Index funds are easy to understand and ideal for beginners in mutual fund investments.

- Consistent Returns: They replicate market performance, which delivers returns consistent with the benchmark index.

- No Fund Manager Risk: Performance isn’t impacted by fund manager decisions, avoiding human errors.

- Transparent Portfolio: Investors know exactly what the fund holds since it mirrors the benchmark index.

Cons of Index Funds

- No Outperformance: Broad market index funds only match the index returns and cannot outperform the market.

- Limited Flexibility: They cannot adjust to market opportunities or risks like actively managed funds.

- Tracking Error: Small deviations from the benchmark can impact returns due to tracking error.

- Vulnerable to Market Downturns: When the market falls, index funds will also decline since they mimic the index.

- Sector Bias: Index funds may have a higher concentration in certain sectors, leading to an unbalanced portfolio.

- Longer Time Horizon Needed: They are better suited for long-term investors; short-term market fluctuations can impact returns.

Why You Should Choose Strategy-Based Index Funds Over Regular Index Funds

Investors are increasingly adopting index funds as a core part of their portfolios due to their simplicity and cost-effectiveness. While regular or broad market index funds, such as those tracking the Nifty 50 or Sensex, are popular, strategy-based index funds provide a unique opportunity to align investments with specific financial goals and market dynamics. Here’s why they might be a better choice:

1. Customizable Strategies for Market Needs

- Regular Index Funds: Track broad indices like Nifty 50, Sensex, or Nifty Next 50, which are heavily weighted toward large-cap stocks.

- Strategy-Based Index Funds: Offer exposure to smart beta strategies such as low volatility, quality, value, or momentum, designed to cater to specific investment preferences. For example:

- Nifty Alpha Low Volatility 30 Index Funds focus on stocks with lower price fluctuations, appealing to risk-averse investors.

- Nifty Alpha 50 Index Funds prioritize stocks with high alpha generation potential.

2. Factor-Based Investing for Superior Risk-Adjusted Returns

Strategy-based index funds leverage factors like:

- Alpha: Tracks the performance of stocks with the highest alphas with indices like the Nifty Alpha 50.

- Momentum: Capture trends with indices like the Nifty 500 Momentum 50.

- Value: Focus on undervalued companies in indices like the Nifty 500 Value 50.

- Quality: Invest in fundamentally strong companies with indices like the Nifty Smallcap250 Quality 50.

These strategies can potentially outperform traditional indices during specific market cycles, unlike broad market index funds that simply mirror overall market performance.

3. Risk Mitigation Volatile Markets

- Indian markets are prone to volatility due to macroeconomic factors, global events, and currency fluctuations.

- Strategy-based funds like low volatility funds (e.g., Nifty100 Low Volatility 30) help investors reduce portfolio risks during market downturns, providing more stability than traditional index funds.

4. Cost Efficiency with Enhanced Potential

- While strategy-based index funds might have slightly higher expense ratios than regular index funds, they remain significantly cheaper than actively managed funds.

- These funds offer the dual benefit of low costs and smart strategy implementation, which makes them attractive to cost-conscious investors.

In conclusion, if you are a beginner investor who has just started their investing journey, go with regular index funds. They are less volatile and have historically provided decent returns. On the other hand, if you are an intermediate to expert-level investor who can handle market volatility, maintain a long-term investment horizon, and expect higher returns, then go with strategy-based index funds.

Examples of Strategy-Based Index Funds

- Bandhan Nifty Alpha 50 Index Fund

- Nippon India Nifty 500 Momentum 50 Index Fund

- Edelweiss Nifty Midcap150 Momentum 50 Index Fund

Examples of Regular Index Funds

- Nippon India Index Fund Nifty 50 Plan

- Kotak Nifty Next 50 Index Fund

- Edelweiss NIFTY Large Mid Cap 250 Index Fund

FAQs

Which NIFTY 50 Index Fund is best?

Nippon India Index Fund Nifty 50 Plan is a best NIFTY 50 Index Fund to invest in India’s top 50 companies.

Is the NIFTY 50 Index Fund safe?

The Nifty 50 Index Fund is not completely safe, but it is less volatile and safer than other equity mutual funds.

How to know if an index fund is good?

First, expense ratio is crucial; a lower ratio (ideally around 0.20% or less) indicates that more of your money is working for you rather than going towards fees. Also, note that the expense ratio for strategy-based index funds may be slightly higher (ideally around 0.30% or less).

Second, tracking error measures how closely the fund follows its benchmark index; a tracking error of less than 1% is preferable as it suggests effective replication of index performance.

Third, consider the fund size; larger funds generally offer better liquidity and lower expenses due to economies of scale. Additionally, assess the fund provider’s reputation, as established fund houses typically provide better management and transparency.

Finally, review the fund’s historical performance against its benchmark over various time periods, ensuring it consistently tracks well, which can indicate reliability for future returns.

Is Tata Nifty 50 Index Fund good?

Tata Nifty 50 Index Fund is a good fund, but not the best. Here’s why:

1. Its expense ratio is slightly higher than that of other Nifty 50 index funds.

2. There are charges for the exit load, whereas other Nifty 50 funds are available with no exit load.

3. The minimum lumpsum investment starts at ₹5000, while other funds are available with a minimum lumpsum option of ₹100.

If you are looking for an alternative to the Tata Nifty 50 Index Fund, the Nippon India Index Fund Nifty 50 Plan addresses all the deficiencies of the Tata Nifty 50 Index Fund.

Is index fund good for beginners?

Yes, index funds are an excellent choice for beginners because they are simple, cost-effective, and provide diversified exposure to the market. These funds aim to replicate the performance of a specific index, such as the Nifty 50 or SENSEX, which makes them less risky than actively managed funds.

With low expense ratios and no need for active decision-making, index funds allow beginners to invest with ease while benefiting from long-term market growth. They are ideal for those who want steady returns without extensive research or market expertise.

Can I invest 1000 rs in index funds?

Yes, you can invest ₹1000 in index funds. But make sure that the index fund scheme accepts at least ₹1000 or less for SIP or lumpsum investments.

What is the return rate of index funds?

The return rate of index funds varies based on the underlying index they track, the market performance, and the specific fund. For large-cap index funds, such as those tracking the Nifty 50 or Sensex, annualized returns typically range from 11% to 14% over the long term. For strategy-based or mid-cap/small-cap index funds, returns can be higher—some strategy-based indexes, like the Nifty 500 Momentum 50 Index, have provided annualized returns of over 20% over a decade.

Which index fund has the best returns?

The Nifty Alpha 50 Index Fund has the best returns, followed by the Nifty 500 Momentum 50 Index Fund.

Index fund investing is a great option for investors who want passive investing without the need to check the portfolio frequently. With a low expense ratio and top-performing stocks in an index, it grows your money smoothly. The decision is yours, whether you want stable returns with moderate risk through regular index funds or higher returns with increased risk. Make sure to do proper research and seek help from professionals to invest correctly according to your investment goals.

Like this article? Get our weekly newsletter

Free newsletter with the best mutual fund stories every week!

Leave a Reply

You must be logged in to post a comment.