In the modern world, investing has become very easy. You just need a phone and an internet connection to start investing. There are various brokers available in India that let you safely invest in any mutual fund scheme. In this article, I will share my story of how I finally moved my investments from a demat account to a Statement of Account within two days.

I initially started investing through Dhan. But a few months later, I realized that their platform is designed for traders, not investors. There were frequent promotional emails, in-app popups about trading, and more. Then, I finally decided to shift to India’s biggest investing platform, Groww, which is pretty good from an investor’s point of view. Their UI is simple and easy to use.

To properly manage my holdings, I shifted all my mutual fund holdings to new folios created through Groww. I started investing via Groww in April 2025.

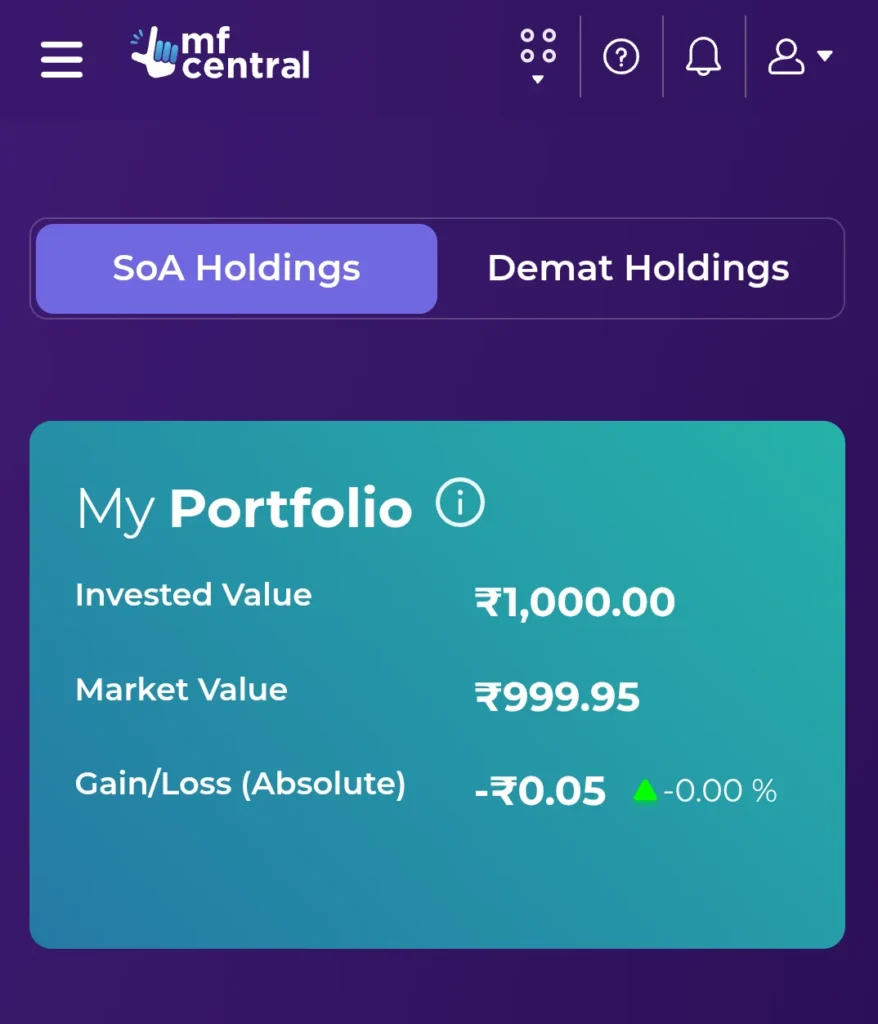

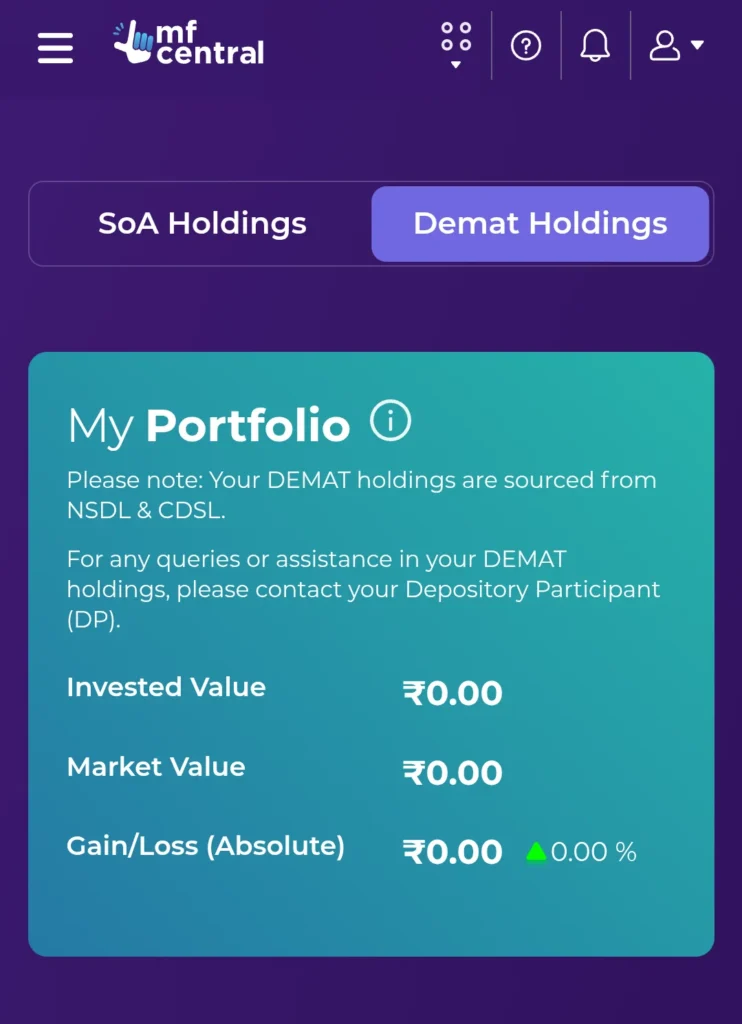

I was unaware that my investments made through Groww were in demat format. But on June 16, when I checked my holdings on MF Central, I found that 100% of my investments were in demat format, whereas they were previously in SOA (Statement of Account) format when invested through the Dhan app.

This means that when I redeemed my invested funds in April 2025 and re-invested through the Groww app, they were processed in demat format. After discovering this, I first opted out of demat holding.

To OPT-OUT from demat to SOA on Groww, you need to visit their official page. Then click on the OPT-OUT button, then if you are not logged in to the Groww website, then login with Google account or email id. Then use the Groww 4-digit pin to access the final page.

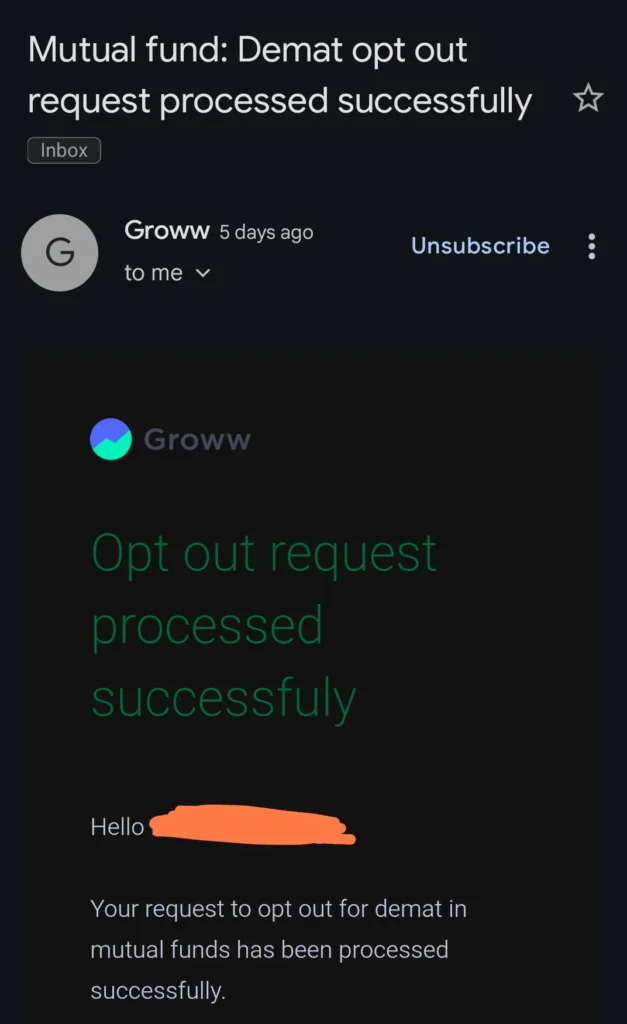

Then you will see the Demat opt-out page with a 6-digit OTP input field. An OTP has already been sent to your registered email address and mobile number. Enter the correct OTP. After that, you will see a message saying “Opt-out request received,” which means you will shortly receive an email confirming that your opt-out request has been processed successfully.

If your Groww holding type is already in SOA format, you will see a notice saying, “You have already opted out of demat investments for mutual funds,” after entering the Groww PIN.

After OPT-OUT from demat, I have two choices to convert my existing fund holdings from demat to SOA format. First one is filling the Mutual Fund Restatementization Request Form. This form was provided to me when I contacted Groww customer care. You can fill that form and send to the email adress [email protected]

You can also Raise a ticket via Customer support’s “Email us” section in the Groww app and make sure to include the filled form through the Add file button.

The second method is very simple. After opting out from demat to SOA, you just need to redeem your investments that are in demat format and re-invest the amount again. This time, the investment will be made in SOA format.

To check which mutual fund investments are in SOA or demat format, you can use the MF Central platform. Sign in or sign up on MF Central, then click on View Portfolio to check both SOA and demat holdings. We have an in-depth article about MF Central — link below.

If your portfolio has an amount listed under the Demat Holdings section, it means those funds have been invested in demat format, not SOA.

The biggest disadvantage of demat holdings is that you can’t redeem your investments through other apps. For example, if you invested in demat format via the Groww app, you won’t be able to redeem those investments through Zerodha or platforms like MF Central. But in the case of SOA format, you can redeem your investments through any platform, including MF Central.

Like this article? Get our weekly newsletter

Free newsletter with the best mutual fund stories every week!

Leave a Reply

You must be logged in to post a comment.