Investing in mutual funds comes with risk. There are several types of funds available in the market. Some types of funds really offer low risk on investment, which means investing in those low risk funds may offer a more stable and predictable return. If you are looking for the best and safest mutual funds, you are in the right place. In this article, we discuss the best mutual funds where the invested amount tends to remain safer compared to many other funds.

As we mentioned above, below the top headline, low risk funds are to grow your existing wealth and to beat the inflation. If you want to build wealth, then high risk mutual funds may be a better option.

Table of Contents

What are actually Low Risk Funds?

Low risk mutual funds are investment options designed to minimize potential losses while providing relatively stable returns. These funds primarily invest in safer, more predictable assets such as government bonds, high-quality corporate bonds, and money market instruments. They are particularly appealing to conservative investors who prioritize capital preservation over aggressive growth strategies. While no investment is entirely free of risk, low risk funds aim to mitigate exposure to market volatility and provide a consistent income stream.

One of the most common types of low risk funds is debt mutual funds, which include categories like liquid funds, ultra-short-duration funds, and overnight funds. These funds invest in fixed-income securities that are less susceptible to fluctuations in interest rates compared to equities.

For example, liquid funds typically invest in short-term debt instruments with maturities of up to 91 days, which offers high liquidity and low credit risk. This makes them suitable for investors looking for a safe parking place for their surplus cash while earning better returns than traditional savings accounts or fixed deposits.

Another important characteristic of low risk funds is their diversification strategy. By spreading investments across various asset classes and sectors, these funds reduce the impact of any single investment’s poor performance on the overall portfolio. This approach not only minimizes risk but also helps maintain a more stable return profile.

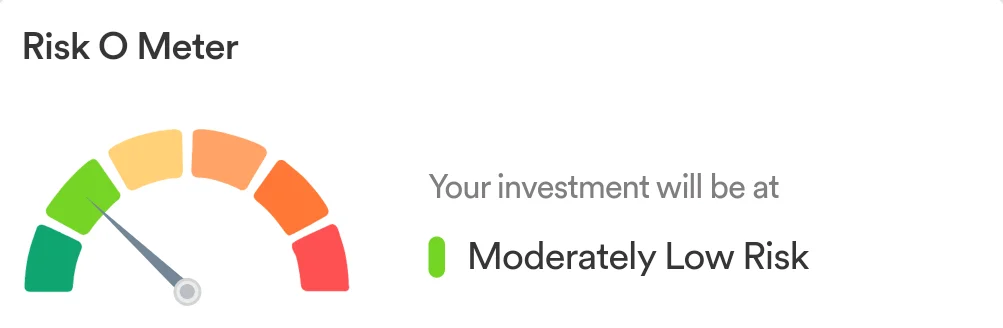

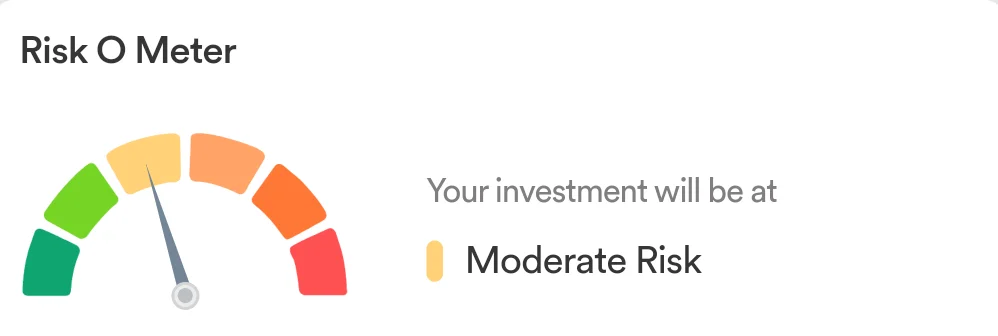

With each low risk fund, we have included the Riskometer to mention the risk level of that perticular fund. There are 6 levels of Riskometer available for mutual funds:

Low, Moderately Low, and Moderate risk levels are generally considered low risk funds, while Moderately High, High, and Very High risk levels are generally considered more risky funds.

1. Invesco India Arbitrage Fund

Invesco India Arbitrage Fund is a hybrid mutual fund that can grow your investments with low risk. It has rated 5-stars by Value Reserch, and provided more than 6% CAGR returns in the last 5 years.

Arbitrage Funds are a specialized category of mutual funds that primarily exploit price discrepancies between the cash and futures markets to generate returns. These funds engage in simultaneous buying and selling of the same asset across different markets, capitalizing on the differences in pricing to secure profits with minimal risk.

Arbitrage Funds are typically classified as hybrid funds, they invest at least 65% of their portfolio in equities, while the remainder may be allocated to debt instruments for liquidity management. This strategy allows them to offer relatively stable returns, particularly appealing during periods of market volatility.

2. Kotak Equity Arbitrage Fund

Kotak Equity Arbitrage Fund is also a Arbitrage fund to grow money with low risk. It has more than 50,000 crore AUM. If you prefer liquidity in mutual funds, then this low risk fund could be a great choice. However, there is a separate Liquid fund type available in the Debt category. Kotak Equity Arbitrage Fund has provided more than 6% CAGR returns in the last 5 years.

3. Axis Overnight Fund

Axis Overnight Fund is a debt mutual fund under the type of overnight. Overnight mutual funds are a specialized category of debt mutual funds designed for short-term investments. They primarily invest in securities that mature within one business day, which makes them a highly liquid and low-risk option for investors looking to park surplus cash temporarily. Overnight mutual funds offer the lowest expense ratio compared to any other fund type.

4. Nippon India Liquid Fund

Nippon India Liquid Fund offers higher liquidity while growing your money safely. Liquid mutual funds are a type of debt fund that primarily invest in short-term instruments like treasury bills, commercial papers, and certificates of deposit, with maturities up to 91 days. They offer high liquidity, which allows investors to redeem their investments within one business day (T+1).

Nippon India Liquid Fund has provided more than 5% CAGR returns in the 5 years and it has more than 30,000 crore AUM.

5. ICICI Prudential Banking & PSU Debt Fund

ICICI Prudential Banking & PSU Debt Fund is a high rating debt mutual fund that invests in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds while maintaining the optimum balance of yield, safety and liquidity. Morningstar and Value Research both rated ICICI Prudential Banking & PSU Debt Fund as 5-stars.

Note: Those mutual fund ratings may change over the time based on the fund performance. It is good to check ratings before investing if you value mutual fund ratings.

6. ICICI Prudential Corporate Bond Fund

ICICI Prudential Corporate Bond Fund has provided more than 7% CAGR and more than 40% absolute returns in the last 5 years. This low risk fund also has a 5-star rating from Morningstar and Value Research.

Corporate Bond Funds primarily invest over 80% of their assets in corporate bonds, which are debt securities issued by companies to raise capital for various operational needs. These funds typically focus on high-quality bonds, often rated AA or above, which provides investors with a relatively stable income stream and the potential for capital appreciation.

7. Axis Ultra Short Duration Fund

Axis Ultra Short Duration Fund is a debt mutual fund for short term investors with a 3 to 6 month investment horizon and it is considered as a low risk fund.

Ultra Short Duration Funds are a type of fixed-income mutual fund that primarily invests in debt and money market securities, with a focus on maintaining a Macaulay Duration of 3 to 6 months. These funds aim to provide higher returns than traditional savings accounts while minimizing risk, which make them suitable for conservative investors looking for short-term investment options. They typically invest in high-quality instruments such as corporate bonds, treasury bills, and commercial papers, which helps mitigate interest rate fluctuations.

8. ICICI Prudential Floating Interest Fund

ICICI Prudential Floating Interest Fund comes under Floater fund of the debt mutual fund category. Floating Interest Fund, also known as a floating rate fund, is a type of mutual fund that primarily invests in financial instruments with variable interest rates, such as bonds and loans. These funds are designed to provide investors with returns that adjust in response to changes in market interest rates, making them particularly attractive during periods of rising rates.

By investing at least 65% of their assets in floating-rate securities, these funds aim to mitigate interest rate risk, which allow investors to benefit from higher yields when interest rates increase. Floating interest funds typically include corporate bonds and bank loans, and they offer a diversified portfolio with lower sensitivity to interest rate fluctuations.

9. DSP Strategic Bond Fund

DSP Strategic Bond Fund is a dynamic bond debt mutual fund with more than 7% CAGR within last 5 years. Even though dynamic bond mutual funds are low risk funds, they have that potential to provide more return compared to other debt funds.

Dynamic Bond Funds are flexible debt mutual funds that actively manage their investment durations to capitalize on changing interest rates. Fund managers adjust the portfolio’s composition between short and long-term bonds based on their interest rate outlook, which aims to enhance returns regardless of market conditions. This adaptability allows them to mitigate risks associated with rising or falling interest rates, which makes them suitable for investors who want stable income and potential capital gains over time.

10. Aditya Birla Sun Life Money Manager Fund

Aditya Birla Sun Life Money Manager Fund is a money market debt fund with 5-star ratings. The fund has provided over 6% CAGR return in the last 5 years with AUM value of more than 25,000 crore.

Money Market Funds are a type of debt mutual fund that primarily invests in short-term instruments with maturities of up to one year, such as treasury bills, commercial papers, and certificates of deposit. They aim to provide investors with liquidity and relatively stable returns.

Which fund is the Safest?

In the Hybrid funds category, Invesco India Arbitrage Fund is the safest, while in the Debt funds category, Axis Overnight Fund is the safest.

Low risk taking investors may expect an average of 6% CAGR returns. Generally, low risk funds tend to deliver returns between 5% and 8% per annum.

Advantages of Low Risk Funds

Stability and Predictability

- Consistent Returns: Low risk funds typically invest in government bonds, high-rated corporate bonds, and money market instruments, which tend to offer more stable returns compared to equities. This stability is particularly appealing during market volatility.

- Capital Preservation: These funds focus on maintaining the capital invested, making them suitable for conservative investors who prioritize safeguarding their assets against market fluctuations.

- Inflation Protection: Many low risk funds are structured to counteract inflationary pressures, ensuring that the purchasing power of the invested capital is preserved over time.

Liquidity

- Easy Access to Funds: Low risk mutual funds generally allow for quick liquidation, which provides investors with easy access to their money when needed. This liquidity is an attractive feature for those who may require funds on short notice.

Professional Management

- Expertise: As managed by professional fund managers, these funds benefit from expert decision-making aimed at optimizing returns while minimizing risk. This professional oversight can help navigate complex market conditions effectively.

Tax Efficiency

- Potential Tax Benefits: Compared to traditional savings accounts or fixed deposits, low risk mutual funds can be more tax-efficient. They may offer better after-tax returns, especially for investors in higher tax brackets due to potential capital gains tax advantages.

Disadvantages of Low Risk Funds

Lower Returns

- Limited Growth Potential: While low risk funds offer stability, they typically provide lower returns compared to higher risk investments like equities. This can be a disadvantage for investors seeking significant capital appreciation over the long term.

Inflation Risk

- Purchasing Power Erosion: If the returns from low-risk investments do not keep pace with inflation, the real value of the investment may decline over time. This means that even though the nominal value of the investment might increase, its purchasing power could diminish. So, it is important to choose top-performing, low risk funds that have shown at least 5% to 7% returns historically.

Fees and Expenses

- Management Fees: Many low risk mutual funds come with management fees that can eat into overall returns. It’s essential for investors to be aware of expense ratios and other costs associated with these funds, as they can impact net gains.

Info! Most of the mutual funds mentioned in this article offer a lower expense ratio. Additionally, you may consider choosing an Overnight Fund for a lower expense ratio.

FAQs

Are mutual funds 100% safe?

No, mutual funds are not 100% safe. Even though FDs are not risk-free. But there are some types of funds available that may be better than FDs. For example, some debt and hybrid mutual funds offer low-risk investment opportunities, while equity funds are high-risk investments.

What is the safest type of mutual fund?

Debt and Hybrid funds are the safest type of mutual funds, with the lowest risk. Some of the safest debt fund types include Overnight, Money Market, and Floater funds. In hybrid funds, Arbitrage is considered the safest option.

What are the highest performing mutual funds?

Some of the highest performing mutual funds are Nifty 500 Momentum 50 Index Fund, Nifty Alpha 50 Index Fund, Nippon India Small Cap Fund, Quant Infrastructure Fund, Motilal Oswal Midcap Fund. These are top and highest performing funds with high risk. Because these are the Equity mutual funds, not Debt and Hybrid funds. Low risk funds offer lower returns, while high risk funds offer higher returns.

Can we get 15% return on mutual fund?

Yes, it is possible to achieve a 15% return on mutual funds by investing in certain equity funds, which tend to be volatile. Some categories include smallcap funds, alpha funds, momentum funds, and sectoral/thematic funds. You may even earn more than a 15% return, but there is no guarantee of achieving this. The stock market is uncertain.

That’s it for the safest and low risk funds. Did you find the article helpful? Do share your opinion about these funds or if you have any questions. We are always excited to reply our readers’ valuable feedback.

Like this article? Get our weekly newsletter

Free newsletter with the best mutual fund stories every week!

Leave a Reply

You must be logged in to post a comment.